sales tax fremont ca 2019

2 beds 2 baths 1450 sq. Some areas may have more than one district tax in effect.

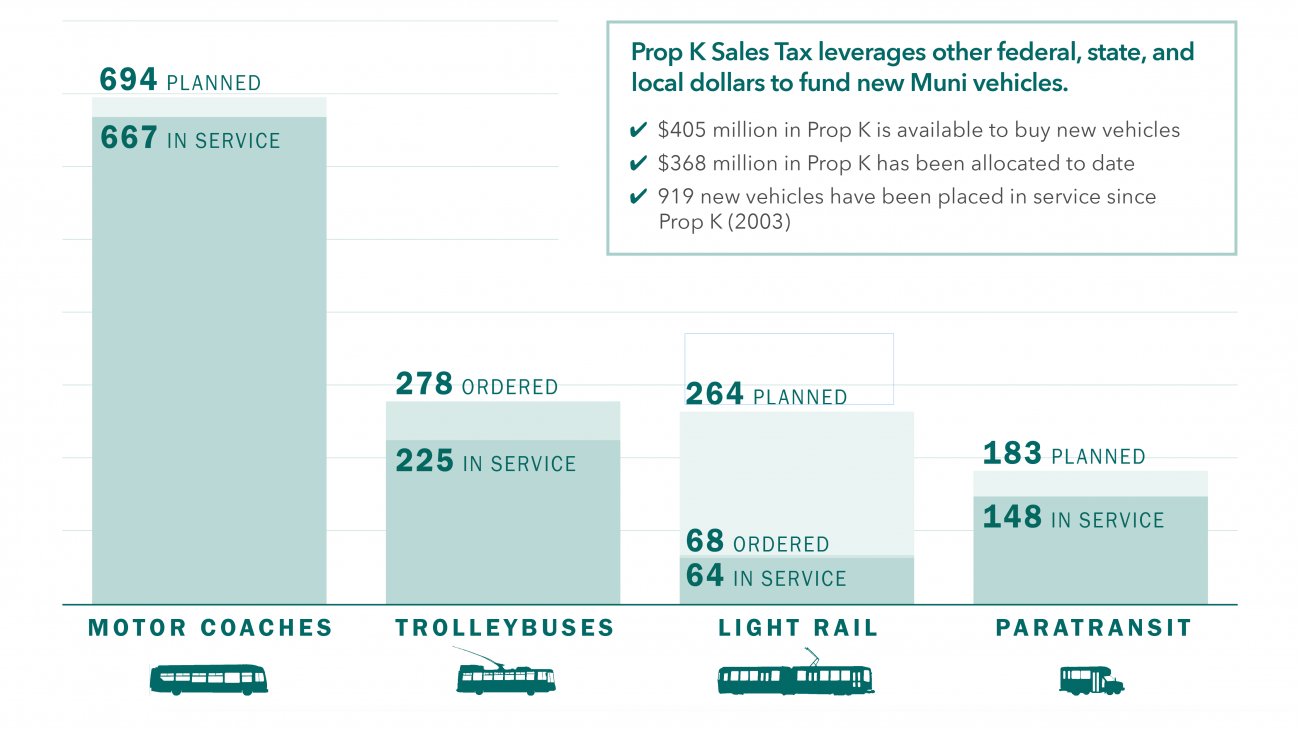

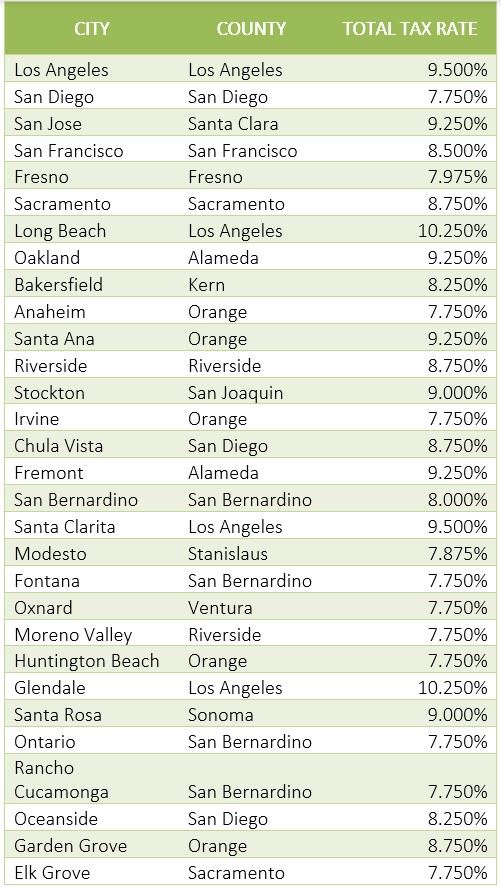

Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent.

. Taxes in San Jose California are 62 cheaper than Fremont California. There is no applicable city tax. View sales history tax history home value estimates and overhead view.

Huntington Beach CA Sales Tax Rate. Online videos and Live Webinars are available in lieu of in-person classes. The Fremont sales tax rate is.

Those district tax rates range from 010 to 100. Calculation of the general sales taxes of 94539 fremont california for 2021. Businesses impacted by the pandemic please visit our.

Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent. The 1025 sales tax rate in Fremont consists of 6 California state sales tax 025 Alameda County sales tax and 4 Special tax. What is the sales tax rate in Fremont California.

When was 38870 Hayes Street Fremont CA 94536 last sold. The December 2020 total local sales tax rate was also 7750. The sales and use tax rate in a specific California location has three parts.

The December 2020 total local sales tax rate was 9250. Average Sales Tax With Local. Historical Sales Tax Rates for Fremont 2022 2021 2020 2019.

The 6 sales tax rate in Fremont consists of 6 Michigan state sales tax. You can print a 6 sales tax table here. The current total local sales tax rate in Fontana CA is 7750.

The 95 sales tax rate in Valencia consists of 6 California state sales tax 025 Los Angeles County sales tax and 325 Special tax. Fremont CA Sales Tax Rate The current total local sales tax rate in Fremont CA is 10250. And Seattle Washingtonare tied for the second highest rate of 1025 percent.

Birmingham Alabama at 10 percent rounds out the list of. Next to city indicates incorporated city City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc. Fremont CA Sales Tax Rate.

Below 100 means cheaper than the US average. For questions about filing extensions tax relief and more call. You can print a 1025 sales tax table here.

Chula Vista CA Sales Tax Rate. The California sales tax rate is currently. The minimum is 725.

31 rows Bakersfield CA Sales Tax Rate. Bidders must Bidders need not be present at the Courthouse. Fremont collects the maximum legal local sales tax.

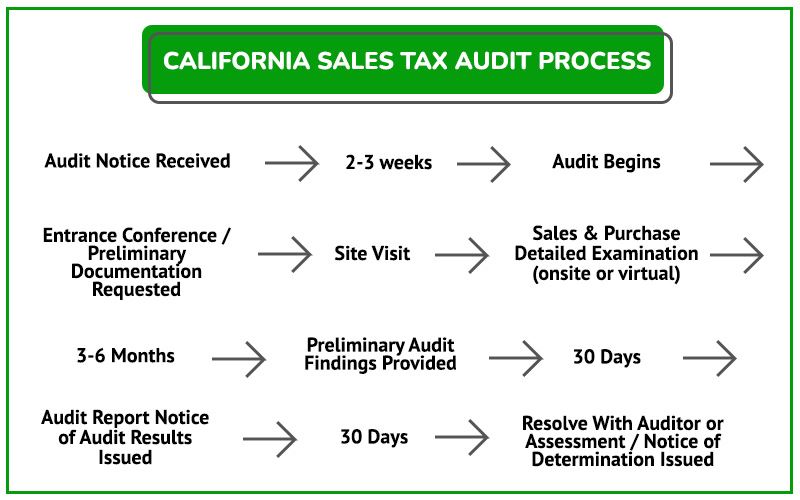

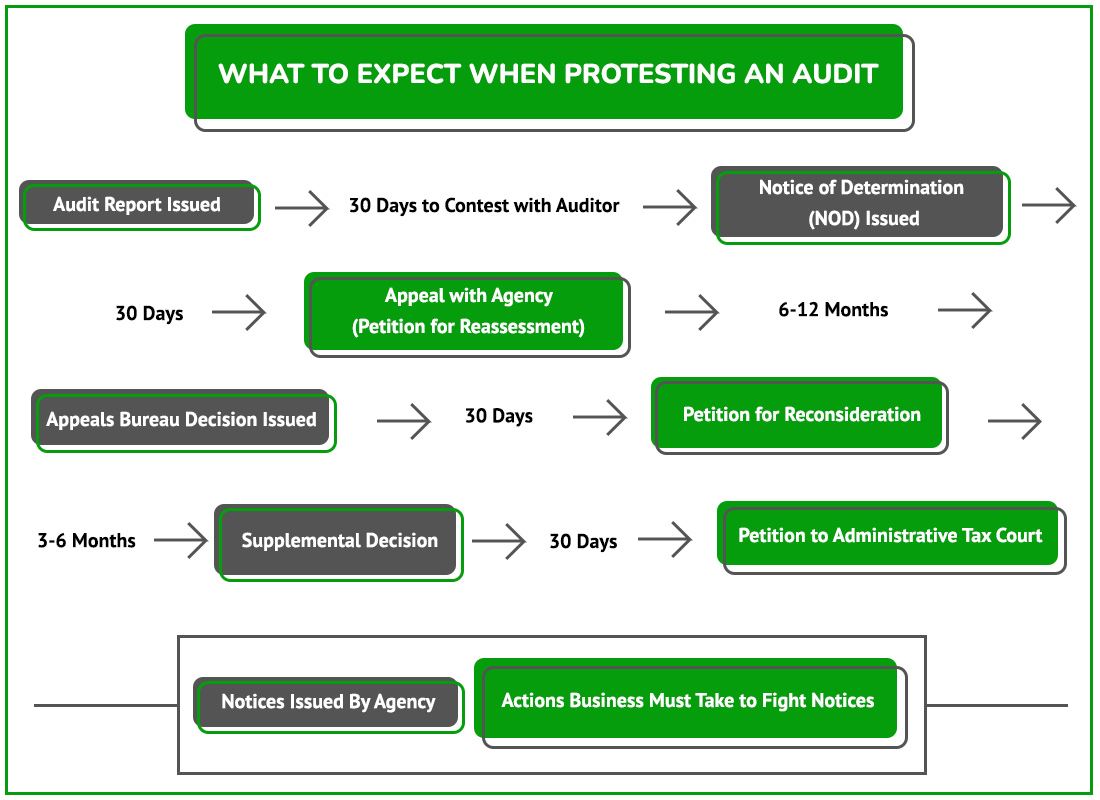

State sales and use taxes provide revenue to the states General Fund to cities and counties through specific state fund allocations and to other local jurisdictions. 1788 rows CDTFA public counters are now open for scheduling of in-person video or phone appointments. These rates are weighted by population to compute an average local tax rate.

California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. Glendale CA Sales Tax Rate. California 1 Utah 125 and Virginia 1.

For tax rates in other. California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 1 P a g e Note. There is no applicable county tax city tax or special tax.

This is the total of state county and city sales tax rates. The state tax rate the local tax rate and any district tax rate that may be in effect. Wayfair Inc affect California.

The statewide tax rate is 725. Fontana CA Sales Tax Rate. Five other citiesFremont Los Angeles and Oakland California.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Above 100 means more expensive. Three cities follow with combined rates of 10 percent or higher.

For tax rates in other cities see Puerto Rico sales taxes by city and county. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent. Sellers are required to report and pay the applicable district taxes for their taxable.

City sales and use tax rate. Fontana CA Sales Tax Rate. Fremont CA Sales Tax Rate.

Fresno CA Sales Tax Rate. Townhouse located at 48942 Lady Fern Cmn Fremont CA 94539 sold for 850000 on Aug 19 2019. Garden Grove CA Sales Tax Rate.

Hollywood CA Sales Tax Rate. The County sales tax rate is. Many local sales and use tax rate changes take effect on April 1 2019 in California as befits its size.

You can print a 1025 sales tax table here. The current total local sales tax rate in Fremont CA is 10250. The minimum combined 2022 sales tax rate for Fremont California is.

The calculator will show you the total sales tax amount as well as the county city and special. There is no applicable county tax city tax or special tax. Please contact the local office nearest you.

Real property tax on median home. B Three states levy mandatory statewide local add-on sales taxes at the state level. Our Premium Calculator Includes.

State Local Sales Tax Rates as of January 1 2019 a City county and municipal rates vary. There is no applicable city tax. We include these in their state sales tax.

The sales tax jurisdiction name is Santa Clarita Tourism Marketing District which may refer to a local government division. You can print a 95 sales tax table here. 100 US Average.

The District of Columbias sales tax rate increased to 6 percent from 575 percent. 38870 Hayes Street Fremont CA 94536 was last sold in 12132018. Wayfair Inc affect California.

Assessed at 753671 the tax amount paid for 38870 Hayes Street Fremont CA 94536 is 8533. There is no applicable city tax. There is no applicable city tax.

Did South Dakota v. The 1025 sales tax rate in Fremont consists of 6 Puerto Rico state sales tax 025 Alameda County sales tax and 4 Special tax. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Camino 7250 El Dorado Camp Beale 7250 Yuba Camp Connell 7250 Calaveras Camp Curry 7750 Mariposa Camp Kaweah 7750 Tulare Camp Meeker 8125 Sonoma Camp Nelson 7750 Tulare Camp Pendleton 7750 San Diego.

4 beds 3 baths 3061 sq. About our Cost of Living Index. There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617.

California Sales Tax Guide For Businesses

California City County Sales Use Tax Rates

How To File And Pay Sales Tax In California Taxvalet

How To File And Pay Sales Tax In California Taxvalet

Complete 8 Step Guide To Investing In Opportunity Zones Investing Investment Property Alameda County

How To File And Pay Sales Tax In California Taxvalet

Tax Checklist For The Self Employed Military Spouse Nextgen Milspouse Tax Checklist Military Spouse Milspouse

California Sales Tax Rates By City County 2022

California Sales Tax Guide For Businesses

22761 Blue Teal Dr Canyon Lake Ca 92587 Mls Sw16068568 Zillow Waterfront Homes Canyon Lake Lake

Back In Black California Solar Manufacturer Delivers A Handsome 19 4 Efficient Panel Electrek Tesla For Sale Electric Car Charging Electric Cars

How To File And Pay Sales Tax In California Taxvalet

How To File And Pay Sales Tax In California Taxvalet

California Sales Tax Guide For Businesses

Boston Ma Real Estate Boston Homes For Sale Realtor Com Boston Real Estate Real Estate Estates

4414 Sw Eleanor Ln Portland Or 97221 Zillow In 2022 Eleanor Elementary Schools Middle School Grades

Start A High Paying Career As A Virtual Assistant And Earn 20 Per Hour Virtual Assistant High Paying Careers Virtual Assistant Business